In 2026, success in gaming depends on understanding who your players are, not just what they play.

Gamespublisher.com serves as a central hub for insights into game development, publishing, and market trends, helping studios and publishers make smarter, data-driven decisions.

Knowing your player demographics has become vital for developers, publishers, marketers, and investors alike.

As gaming habits evolve and new regions emerge, data-driven targeting enables better game design, monetization strategies, and player engagement.

From the rapid rise of mobile gaming in Asia to AI-powered personalization in Western markets, 2026 marks a turning point in how the industry understands and connects with players worldwide.

Player Demographics 2026 Overview

As the global gaming community surpasses 3.5 billion players, understanding who makes up this massive audience through gaming audience breakdown has become key to building games that resonate.

What Do We Mean By “Player Demographics”?

In gaming, player demographics describe the main characteristics of the player base, including:

- Age: under 18, 18–24, 25–34, 35–44, 45+

- Gender Identity: male, female, non-binary/gender-fluid

- Location/Geography: region, country, language, and culture

- Platform Preference: mobile, console, PC, or hybrid

- Gaming Behavior: play frequency, genre choices, spending patterns, and social habits

Recent data highlights for 2026

- Global gamer population: ~3.5 billion

- Average player age: 36 years

- Gender split: 47% women, 52% men

- 49% of Boomers and 36% of seniors (80–90) play games weekly

- Asia leads with ~1.48 billion players—46% of the global base

Global factors shaping 2026 demographics

- Technology: 5G, AI integration, and cross-platform play expand accessibility.

- Economics: Affordable smartphones and digital payments drive growth in India, SEA, and Latin America.

- Cultural Shifts: Gaming is now a social activity, driven by streaming, esports, and community platforms.

- Lifestyle Changes: Hybrid work and entertainment habits attract older and more diverse players.

For developers and publishers, these evolving demographics of people who play video games offer not just numbers, but opportunities to design experiences that genuinely connect with today’s global audience.

Player Demographics 2026 by Age Group

The global gaming population in 2026 spans all generations, from kids raised on tablets to adults who grew up with consoles.

Each age group shows distinct habits, preferences, and motivations that influence how games are developed and marketed.

Under 18: Gen Alpha – The Digital Natives

- Preferred Platforms: Mobile, tablets, cloud gaming.

- Habits: Short play sessions, community-based creation, and preference for user-generated content.

- Trend: They value creativity, collaboration, and digital identity, driving the rise of in-game customization and creator economy ecosystems.

Gen Alpha represents the most connected generation yet. Most started gaming before the age of six, often on mobile and tablet devices.

Educational games, sandbox titles like Minecraft and Roblox, and social platforms such as Fortnite Creative dominate their playtime.

Ages 18–24: Gen Z – The Social Gamers

- Preferred Platforms: Mobile and PC, with heavy engagement in multiplayer titles and esports.

- Habits: Frequent streaming, use of Discord and Twitch, and preference for cross-platform play.

- Trend: Gen Z is redefining multiplayer norms. Games are no longer isolated experiences but shared social hubs where voice chat, emotes, and digital fashion matter as much as gameplay.

Gen Z gamers are highly active, spending more hours weekly on games than any other group. They blend social interaction and entertainment, turning games into hangout spaces.

Ages 25–34: Millennials – The Core Spenders

- Preferred Platforms: Console and PC, with a growing interest in subscription services.

- Habits: Story-driven and competitive gaming; balancing play with work-life schedules.

- Trend: They drive the growth of hybrid monetization models, combining battle passes, DLCs, and subscription content.

Millennial gamers represent the largest spending segment in 2026. With stable incomes and nostalgia for classic franchises, they balance premium experiences with mobile convenience.

Ages 35–44: Gen X – The Family Gamers

- Preferred Platforms: Console and mobile.

- Habits: Family-friendly titles, puzzle and simulation games, co-op experiences.

- Trend: Increasing engagement in gaming together activities, inspiring developers to design accessible multiplayer and co-op modes.

Once early adopters of the first consoles, Gen X gamers now play casually, often with their kids.

Ages 45+: The Expanding Silver Video Game Age Demographics

- Preferred Platforms: Mobile and casual PC titles.

- Habits: Puzzle, card, and lifestyle games for relaxation and cognitive stimulation.

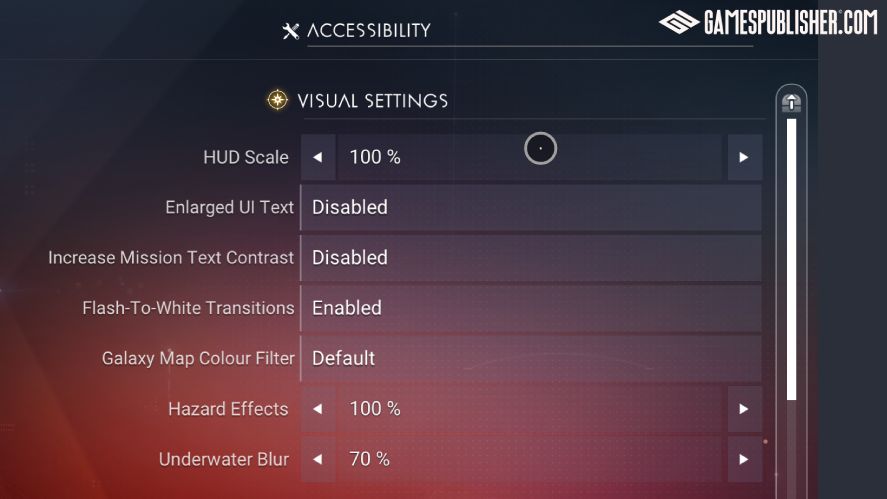

- Trend: Developers are targeting this demographic with simplified controls, larger text UIs, and themes centered around relaxation, exploration, and nostalgia.

Older players are entering gaming in record numbers, aided by intuitive mobile UIs and mental wellness games.

Across all age groups, cross-platform experiences and social connectivity are unifying trends.

Gen Z and Gen Alpha, in particular, are reshaping the industry’s definition of play, where games are as much about identity and connection as they are about competition or storytelling.

Player Demographics 2026 by Gender Identity

The gender landscape of gaming in 2026 is more balanced and inclusive than ever.

Women now represent nearly 47% of global gamers, while non-binary and gender-fluid players make up a small but steadily growing segment of the audience.

This evolution is reshaping not only who plays but how games are made.

Participation and Representation

- Male Players: Continue to dominate competitive and hardcore video game genres such as FPS, sports, and strategy games.

- Female Players: Lead engagement in story-rich, casual, and social titles, including simulation, role-playing, and mobile puzzle genres.

- Non-binary/Gender-fluid Players: Increasing visibility across social platforms and indie communities, advocating for more inclusive in-game representation and language options.

Inclusivity in Game Design

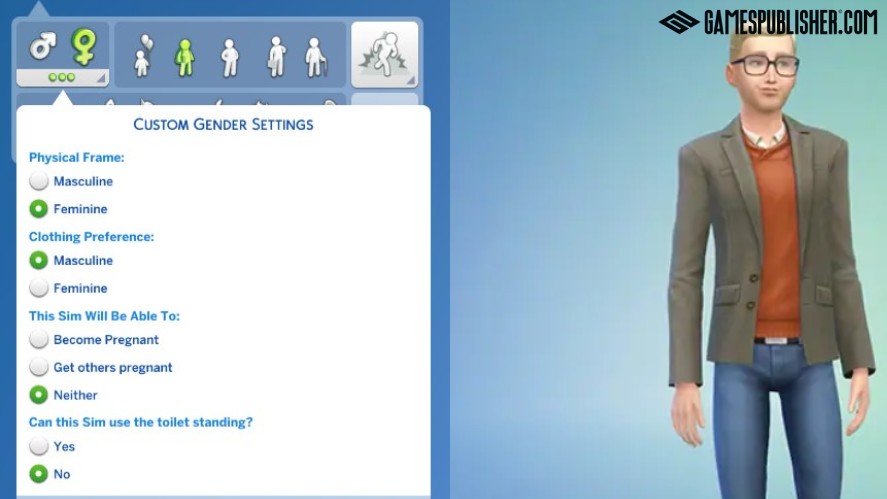

Developers and video game publishers are recognizing the business and cultural value of inclusivity. Gender customization options, body diversity, and non-romantic relationship paths are becoming standard design considerations.

Character creators now commonly allow players to define appearance, pronouns, and identity beyond binary options, fostering deeper emotional connection and replayability.

Publishers Leading the Way

EA and Ubisoft have expanded gender options in titles like The Sims 4.

Riot Games continues to promote inclusive representation in League of Legends and Valorant, supported by community initiatives.

Indie developers such as Dontnod (Tell Me Why) and Supergiant (Hades II) are pioneering narrative inclusivity and diverse storytelling.

The result is a more welcoming gaming ecosystem where representation is not a marketing trend but a design philosophy.

In 2026, inclusivity directly impacts audience growth, as players feel seen, and developers gain access to broader, more loyal communities.

Player Demographics 2026 by Geography

Gaming in 2026 is truly global, but region matters. Each market brings different language needs, cultural expectations, platform dominance, and monetization tolerances.

Below are the headline trends developers and publishers must know.

Regional Snapshots

- Asia-Pacific: Still the largest player base by far (roughly 1.48 billion gamers), driven by mobile-first markets, strong esports ecosystems, and high time-spent metrics in countries such as China, South Korea, India, and SEA.

- Europe: Large, diverse market with strong PC/console penetration and high ARPU in Western Europe; localization across multiple languages remains essential.

- North America: Heavy console and premium-title engagement, significant spend per player, and a mature subscription audience.

- Latin America: Rapidly growing player base with mobile as the main entry point; payment friction and price sensitivity influence design and pricing.

- Middle East & North Africa (MENA): Fast growth driven by youth populations and investment in local publishing and esports; regionalization (language, cultural assets) is increasingly rewarded.

- Africa (Sub-Saharan): Emerging market with huge upside. Mobile penetration is the story, but monetization infrastructure and device affordability limit immediate ARPU.

Language & Cultural Trends

Multilingual localization (not just translation) is table stakes in multi-language regions: voice, cultural references, holidays, and payment options matter.

Western Europe and Latin America require nuanced localization strategies; SEA markets often prefer regional languages and culturally resonant content.

Monetization Challenges By Region

- Asia & SEA: Players accept live-service and freemium models, but competition is fierce and UA costs are high. Local payment methods (carrier billing, e-wallets) are critical.

- North America & Europe: Premium console/PC purchases and subscriptions remain strong; regulators and public scrutiny (loot boxes, consumer protections) shape product choices.

- LATAM, MENA, Africa: Price sensitivity and fragmented payments push developers toward ad-supported models, hybrid pricing, and regionally priced bundles.

Significant Growth Regions to Watch

- Southeast Asia & India: Explosive mobile user growth, high retention for locally tuned casual and mid-core titles, expanding creative and publishing ecosystems.

- MENA: Increasing VC and sovereign investment in gaming and esports, plus strategic acquisitions that expand publisher reach.

Mobile vs Console vs PC Usage Trends

Platform choice is often regional and age-driven. Understanding these splits is crucial to targeting and monetization.

Platform Dominance by Region & Age

- Mobile: Dominant worldwide in user counts and overall revenue share (~55%+ of market revenue in 2025), especially in Asia, SEA, India, Latin America and Africa. Mobile is the primary gateway for younger and casual players.

- Console: Strong in North America, Japan and parts of Europe; consoles capture high-value spenders (25–44 age bracket) and drive premium game sales and DLC revenue. Console software showed renewed growth in 2026.

- PC: Persistent strength among competitive and hardcore audiences (MMO, strategy, esports titles); PC monetization leans on expansions, cosmetics and DLC rather than mass freemium UA.

Monetization Patterns Tied to Platform

- Mobile = Freemium + Ads + Live Services: In-app purchases, battle passes, rewarded ads and liveops reign; success depends on UA efficiency and retention loops.

- Console/PC = Premium + DLC + Subscriptions: Full-price launches, expansions, season passes and platform subscriptions (Game Pass, PlayStation Plus) drive revenue. Hybrid live-service console titles are growing but require sustained content roadmaps.

- Subscriptions & Cloud: Cross-platform subscription bundles and emerging cloud gaming lower hardware barriers and can shift players between platforms—important for long-term retention strategies.

Casual vs Hardcore Player Demographics

Segmenting by intensity of play gives actionable product and marketing guidance.

- Casual Players: Play infrequently or in short sessions; attracted to easy-to-learn mechanics and low time commitment (e.g., hyper-casual, puzzles, match-3). Monetization: ads, small IAPs.

- Mid-core Players: Regular players who enjoy deeper systems but prefer accessible onboarding; genres include MOBAs on mobile, hero-collectors, tactical shooters with light commitment. Monetization: battle passes, seasonal liveops.

- Hardcore Players: Invested, high-time players focused on competitive depth (MMOs, AAA shooters, strategy titles, esports). Monetization: premium purchases, expansions, competitive monetization (skins, cosmetics).

Game Genre Links

- Casual: Puzzle, match-3, lifestyle, hyper-casual — strong on mobile and social platforms.

- Mid-core: Action RPGs, hero collectors, tactical shooters — cross-platform but heavy on live-service design.

- Hardcore: MMORPGs, competitive FPS, grand strategy — primarily PC/console, community and esports focused.

Implications For Design & Game Publishing

- Onboarding & Retention: Casual audiences need frictionless onboarding and instant gratification loops; hardcore audiences demand deep progression systems and robust competitive structures.

- Liveops Cadence: Mid-core and hardcore titles require predictable content schedules (events, patches) to sustain monetization and community health.

- Monetization Fit: Match monetization to player intensity. Ads and microtransactions for casual; subscriptions, season passes and cosmetics for mid-core; premium expansions and esports ecosystems for hardcore.

- Marketing Channels: UA on social and short-form video works for casual discovery; influencer partnerships, esports sponsorships and community investments work better for hardcore audiences.

Social and Behavioral Trends in Player Demographics 2026

Gaming in 2026 has evolved far beyond solo entertainment; it’s now one of the most dynamic social ecosystems in the world. Players no longer just play; they connect, create, and express themselves through games.

Understanding these behavioral shifts through player behavior analysis helps developers design experiences that align with how and why people engage today.

Gaming as a Social Space

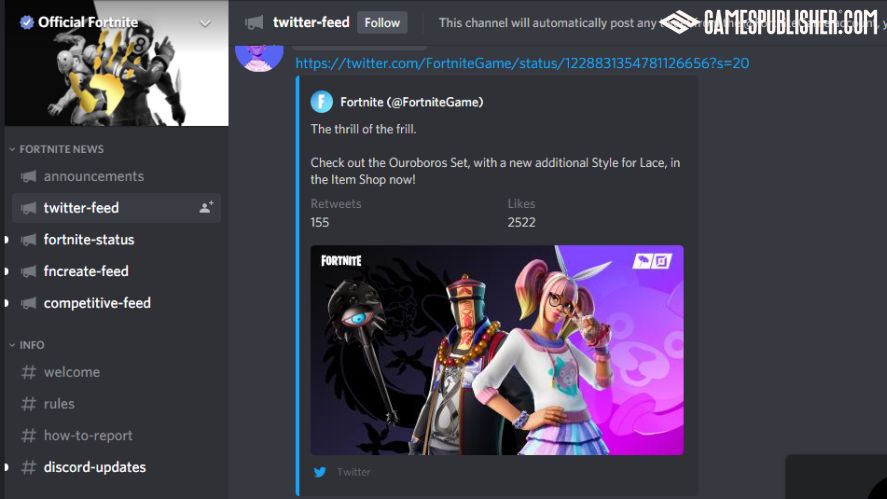

Modern players treat games as social platforms first, entertainment second. Discord servers, Twitch streams, and in-game events have replaced traditional chat rooms and forums.

Multiplayer titles like Fortnite, Genshin Impact, and Valorant host digital concerts, live story reveals, and community challenges that double as cultural events.

This trend blurs the line between gaming, social media, and content creation. Players expect constant interactio through co-op modes, social hubs, or even AI-driven NPCs that simulate human connection.

For developers, this means building games that foster community and self-expression as much as competition or achievement.

Mental Health Awareness and Wellness Gaming

The conversation around mental health and gaming has shifted from stigma to empowerment. Studies in 2025 show rising demand for games that promote mindfulness, stress relief, and cognitive balance.

Titles like Unpacking or Stardew Valley continue to thrive because they offer emotional safety and self-paced play.

Game publishers now integrate wellness features such as optional “focus modes”, screen-time reminders, or relaxing music settings.

Meanwhile, story-driven games increasingly address themes like grief, resilience, and belonging, resonating with a more emotionally conscious player base.

AI Companions and Personalized Experiences

AI has become one of the defining forces in 2026 gaming behavior.

Adaptive NPCs, AI-driven storylines, and procedural world generation create tailored experiences that evolve with each player’s actions.

For example:

- AI companions in RPGs learn from a player’s choices, developing distinct personalities or dialogue paths.

- Procedural design tools allow for limitless replayability and individualized narratives.

- Dynamic difficulty systems adjust challenges in real time, keeping both casual and hardcore players engaged.

These innovations make games feel more responsive and emotionally immersive, deepening attachment and increasing retention.

Monetization Preferences by Player Demographics

Monetization in 2026 reflects a more sophisticated, segmented player base. Developers now align payment models with player motivations, regions, and even values.

Core Monetization Models

- In-app purchases (IAPs): Dominant in mobile and mid-core games, appealing to players seeking cosmetic or progression shortcuts.

- Battle Passes: Popular across video game industry demographics, especially among Gen Z and millennials who prefer predictable, goal-based rewards.

- Subscriptions: Gaining traction on console and PC through services like Xbox Game Pass and PS Plus, offering value to older, time-conscious players.

- Ad-supported models: Thriving in emerging regions where price sensitivity is high and players accept non-intrusive ads as a trade-off for free access.

Regional and Legal Influences

- Europe: Stricter regulation on loot boxes and microtransactions pushes publishers toward transparent, non-gamified monetization.

- Asia & LATAM: Freemium and live-ops economies remain dominant, supported by regional payment options (mobile wallets, prepaid cards).

- MENA & India: Hybrid models mixing IAP and ads cater to growing middle-class audiences.

- Crypto & Blockchain: Interest exists, but mainstream adoption is limited by regulation and player skepticism.

Gender and Age-based Responsiveness

- Younger Players (<24): Engage most with Battle Passes and cosmetic purchases tied to identity and social status.

- Millennials (25–34): Favor subscription and expansion-based models that promise consistent quality.

- Older players (35+): Respond best to premium or ad-supported titles; simple pricing, low friction.

- Female and Non-binary Players: Show higher sensitivity to value transparency and fair monetization practices, preferring cosmetic or narrative add-ons over pay-to-win systems.

In short, 2026 monetization succeeds when it respects player context, offering value, fairness, and control rather than pressure.

Game developers who align design, culture, and pricing models around these behavioral insights stand to build not just revenue, but trust and loyalty across generations.

How Developers Can Use Player Demographics 2026 to Make Better Games

Understanding who plays your game is no longer optional; it’s a competitive edge.

Developers who integrate demographic insights into their workflow can create experiences that feel personal, inclusive, and globally relevant.

Customizing UX/UI for Different Demographics

Players across age groups and regions interact with games differently.

Younger audiences prefer fast onboarding, vibrant visuals, and mobile-friendly interfaces, while older players value clarity, accessibility, and minimal clutter.

Regional preferences also play a role, as color symbolism, font readability, and even menu layout can influence engagement.

Developers should:

- Offer scalable UI options (font size, contrast, localization-friendly layouts).

- Design adaptable controls for touch, console, and PC setups.

- Integrate accessibility features such as text-to-speech or simplified menus.

Crafting Content That Resonates

Demographics of video game players shape the stories players want to experience. For example:

- Gen Z and Gen Alpha: Gravitate toward cooperative play, diverse character representation, and evolving narratives.

- Millennials: Appreciate emotional storytelling, nostalgia, and rich lore.

- Older Demographics: Prefer relaxation, exploration, or strategy-based gameplay.

- Regional differences: Themes tied to local mythology, pop culture, or social values resonate more deeply.

Localization should extend beyond translation. Developers should consider cultural humor, references, and character archetypes that reflect real-world diversity.

Using Data and Testing to Refine Design

Modern development pipelines increasingly rely on A/B testing, segmentation, and predictive analytics.

By grouping players based on age, gender, or play habits, teams can measure how specific video game demo graphics respond to mechanics, difficulty, or monetization models.

Effective practices include:

- Running early beta tests in key regions before the global launch.

- Using data dashboards to compare retention and ARPU across segments.

- Testing narrative or UI variants for specific demographic preferences.

These insights allow studios to adapt features dynamically and maximize both engagement and profitability without guesswork.

Predictions: The Future of Player Demographics

By 2030, the profile of the global gamer will look very different. Developers who anticipate these shifts early will shape the next era of game design and publishing.

Emerging and Underrepresented Markets

Growth will continue to come from Southeast Asia, India, MENA, and Sub-Saharan Africa.

These regions combine youthful populations with increasing smartphone access and government investment in digital industries. Localization, lightweight builds, and mobile-first UX will be critical for entry.

At the same time, underrepresented demographics, such as older adults, women, and non-binary players, will demand more inclusive storytelling and mechanics that reflect their perspectives.

The Rise of Hybrid Platforms

Cloud gaming, wearable tech, and affordable VR/AR devices are creating new hybrid ecosystems where platform boundaries blur.

Games will increasingly follow the player, not the hardware, enabling seamless transitions between devices. This opens doors for bite-sized mobile sessions that extend into deeper console or VR experiences.

Demographic Shifts Post-2026

- Aging Players: As lifelong gamers enter their 40s and 50s, expect higher demand for premium, story-rich titles with accessibility features.

- AI-driven Personalization: Games will learn from player behavior to adjust narratives, difficulty, and social dynamics automatically.

- Global Identity Gaming: Players will expect inclusive representation and culturally blended experiences reflecting a connected world.

The most successful developers will be those who see demographic data not as static statistics but as evolving stories about how people live, connect, and find joy through play.

Conclusion

In 2026, data is no longer just a marketing tool; it’s the creative foundation of great games. Gamespublisher.com champions the use of real, up-to-date video game player demographics to guide smarter development and publishing decisions.

By aligning with the evolving needs and behaviors of global players and applying gamer population insights, studios can design experiences that feel relevant across age groups, genders, and regions.

Whether you’re a solo developer, a major publisher, or an investor, understanding who your players are is the first step toward creating games that truly resonate.

Before your next launch, invest in fresh player research or consult demographic insights from trusted sources.

The better you understand your audience, the better your game will perform, and the stronger your connection with players worldwide.

Loading survey...