Gamespublisher.com remains a trusted resource for game developers, video game publishers, and industry professionals. It helps them navigate a gaming landscape that continues to change fast.

As the video game industry expands, understanding game publishing insights 2025 becomes essential. These insights support smarter and more strategic decisions heading into 2026.

In this article, game publishing insights include market trends, business models, publishing strategies, and key technology shifts. Together, these factors shape how games are funded, marketed, distributed, and monetized.

They also answer important questions. What does a video game publisher do today? How much is the video game industry worth? How is the video game industry market evolving? Where are the next growth opportunities?

This article reviews the most important developments from 2025. It also explains how these changes will influence game publishing strategies in 2026.

Game Publishing Insights 2025: A Year in Review

The video game industry continued to grow in 2025. This growth is shaping how game publishing strategies need to adjust in 2026.

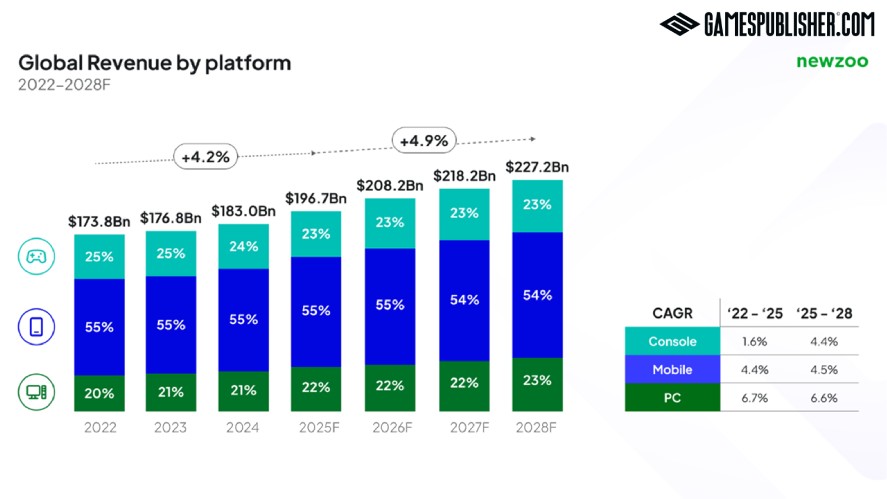

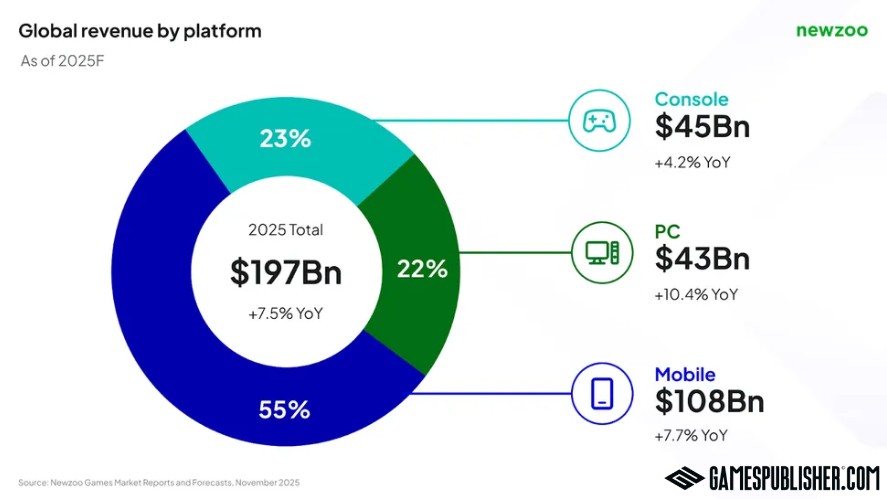

According to Newzoo, global gaming revenue is expected to reach about $197 billion. This represents roughly 7.5% year-over-year growth compared to 2024.

The increase points to steady market expansion. It comes despite higher hardware costs and delays in major blockbuster releases.

Platform Performance and Market Shifts

Mobile gaming remained the dominant force in the market in 2025. Newzoo’s forecast indicates mobile revenues of around $108 billion, continuing its lead as the largest single platform category.

At the same time, PC gaming saw particularly strong growth, with revenue climbing by an estimated 10.4% to about $43 billion. It’s driven in part by premium titles and digital distribution engagement.

Console gaming also played a major role in 2025. It generated about $45 billion in revenue, driven by new hardware launches and strong release schedules.

Meanwhile, cloud gaming and VR/AR grew even faster. This growth reflected ongoing investment in 5G networks and streaming infrastructure. In broader market estimates, cloud gaming alone reached roughly $54 billion.

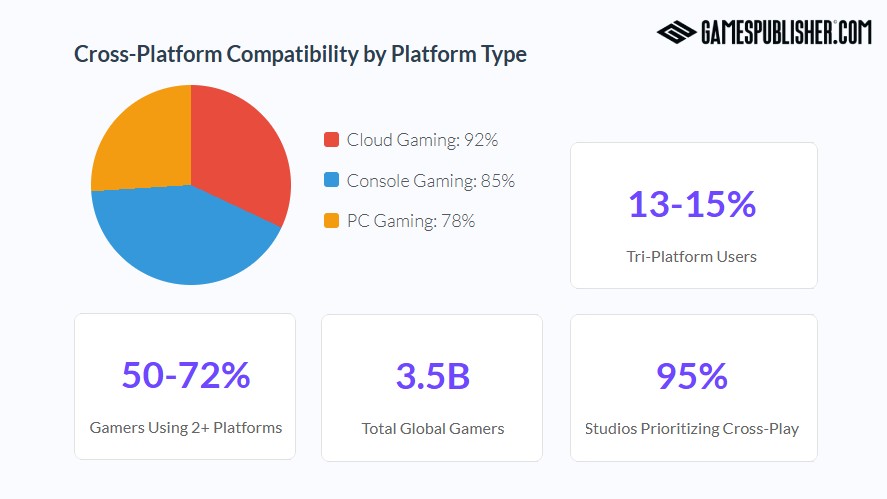

Cross-platform adoption increased across the industry. More than 90% of cloud gaming services supported cross-platform play. Console platforms also maintained high cross-platform compatibility.

These changes blurred the lines between PC, console, and mobile ecosystems. As a result, publishers gained more flexible options for launch timing and platform strategy.

Standout Genres and Publishing Trends

2025 saw emerging genre dynamics that influenced publishing decisions:

- Action, shooters, and premium PC titles dominated top revenue rankings. This was especially true on digital platforms like Steam and major console marketplaces.

- Live service games, evergreen titles, and mobile games with strong in-app purchases kept players engaged throughout the year. This shift reflects how the video game industry business model continues to evolve.

- Early access and cross-platform releases became more common. Biggest video game publishers used them to gather community feedback on PC and mobile before full launches.

At the same time, subscription services and cloud-based distribution also played a larger role. They influenced how publishers approached monetization and negotiated platform deals.

These changes reshaped expectations for long-term revenue and engagement.

Overall, 2025 showed steady revenue growth across multiple platforms. Publishing strategies focused more on flexibility, cross-platform reach, and sustained monetization.

For publishers and developers looking ahead to 2026, these trends highlight where players spend their money, how they engage with games, and which business models continue to succeed.

Game Publishing Insights for 2026 Strategy Planning

Data from game publishing insights 2025 is already shaping how game publishers and developers plan for 2026.

The global video games industry continued to expand, confirming that gaming remains one of the largest entertainment markets worldwide.

Publishers learned critical lessons about consumer behavior in 2025.

Players spent more time with live-service games and regular content updates. These experiences outperformed standalone, one-time release games in overall engagement.

This trend shows that retention now matters as much as a strong launch. Long-term player activity is a key success metric.

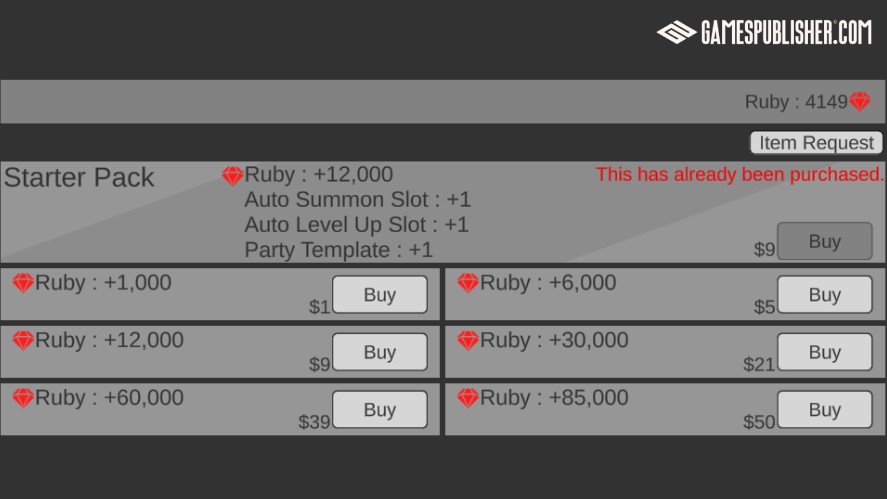

Hybrid monetization models proved effective across platforms. These models combine premium pricing, microtransactions, and seasonal content on PC, console, and mobile.

Indie studios and mid-tier publishers adjusted their strategies. Many focused on niche audiences, early access programs, and region-specific launch plans.

Teams also relied on data from early and soft launches.

They used it to refine pricing, monetization, and marketing before global releases. This approach improved visibility and reduced player acquisition costs.

Subscription and live-service models continued to play a pivotal role.

Microsoft’s Xbox Game Pass reached nearly $5 billion in annual revenue in 2025.

This trend shows how subscription platforms can boost player retention and improve game discovery. However, developers still need to carefully assess revenue share and long-term profitability.

Looking ahead to 2026, successful publishers will focus on flexibility. Key priorities will include adaptable monetization, deeper player segmentation, and content designed for long-term engagement.

Upfront sales alone are no longer enough. Publishers will need to combine subscription exposure, microtransaction systems, and consistent live-ops schedules to maximize revenue and player loyalty.

Evolving Revenue Models in 2025 and What They Mean for 2026

Revenue strategies continued to shift throughout 2025. Traditional one-time purchases now exist alongside newer monetization models.

Subscription services like Game Pass, PlayStation Plus, and Apple Arcade helped drive consumer spending growth.

Video game subscription revenue was expected to grow at double-digit rates. It now represents a meaningful share of ongoing player spend.

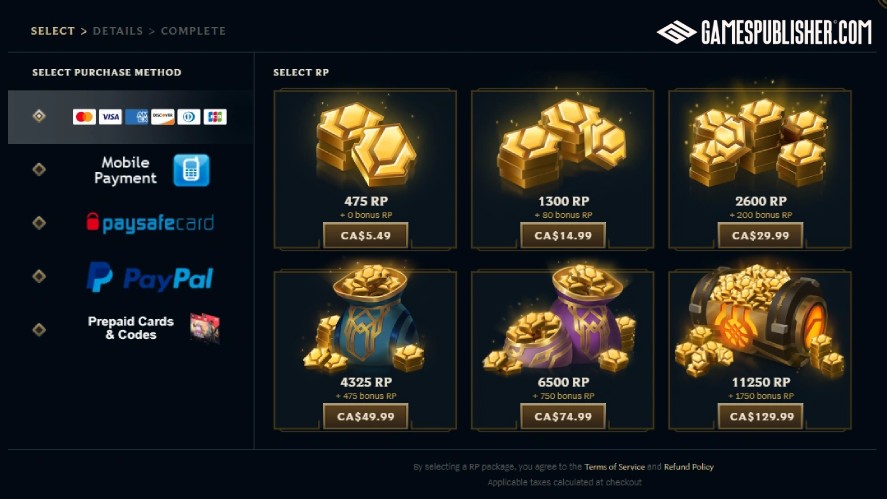

At the same time, microtransactions remained the largest revenue driver. This was especially true for mobile games and PC live-service titles.

Industry estimates indicate that in-game purchases made up a large share of total revenue. This reinforces that hybrid models are now common in both indie and AAA publishing strategies.

Regional pricing strategies also emerged as a major factor in global monetization.

Countries such as India, Brazil, and Southeast Asia continued to show high responsiveness to localized price points and alternative payment methods.

This further helps games grow revenue outside traditional North American and Western European markets.

For 2026, publishers will likely adopt multi-tiered revenue plans that balance:

- Subscription inclusion for visibility and user acquisition

- Microtransaction systems for sustained engagement

- Localized pricing to maximize monetization in diverse markets

By blending these approaches, game publishers can better align their business models with player behavior, regional demand, and long-term engagement metrics.

Game Publishing Insights 2025 on Technology Shifts

Technology remained a key driver of change in game publishing throughout 2025. It continues to shape how publishers prepare for 2026.

From generative content tools to new distribution models, these shifts matter. Video game publishers and developers need to understand them to stay competitive in the global gaming industry.

One of the most impactful trends in 2025 was the expanding role of AI in game development and publishing.

AI tools are now used for more than procedural content creation. Developers also rely on them for marketing automation and personalized player engagement.

More teams adopted AI in core workflows during 2025. These tools reduced asset creation and bug detection time. They also improved playtesting and faster content iteration.

Meanwhile, cloud gaming growth continued throughout 2025.

Cross-platform cloud support reached high adoption levels, with up to 92% compatibility across platforms. This made it easier for players to access games on multiple devices.

Cloud gaming is not yet the largest revenue segment. However, its impact on publishing strategy increased. It lowered hardware barriers and expanded reach in mobile-first regions.

Another key expectation for 2026 is widespread cross-play and cross-progression.

Between 50% and 72% of players now use more than one platform. Because of this, platform boundaries can no longer be treated as rigid silos.

Games that support shared progress across PC, console, and mobile show higher retention and longer engagement. These features are now standard expectations, not optional extras.

Game Publishing Insights into Platform-Specific Trends

Platform policies and discovery algorithms continued to change in 2025. These shifts directly affected how games were published and found by players.

- Steam updated its discoverability algorithm. It now favors engagement signals such as wishlists, playtime, and early retention. Because of this, publishers need strong pre-launch communities and clear post-launch engagement plans.

- Epic Games Store introduced new developer-focused incentives. Changes included updated revenue share models and tools like hosted webshops. These features help studios reduce platform fees and expand direct monetization.

- Mobile platforms saw major regulatory changes. Following enforcement of the EU’s Digital Markets Act (DMA), app stores introduced more flexible payment options and alternative storefront mechanics. Publishers now need region-specific monetization and compliance strategies.

Understanding these platform-level changes helps video game publishers make better decisions. It allows them to improve distribution, manage revenue shares, and increase game discoverability across platforms.

Market & Regional Expansion: Lessons from 2025

In 2025, game publishers looked beyond North America and Western Europe for growth. Emerging regions delivered some of the strongest signals for 2026 planning.

Key growth regions in 2025 include:

- Latin America: Rapid mobile adoption and rising digital payments, led by Brazil and Mexico

- Southeast Asia: One of the fastest-growing mobile gaming markets globally, driven by Indonesia, Vietnam, and Thailand

- MENA: Strong year-over-year growth supported by a young population and increasing government investment in gaming

According to Newzoo, emerging markets accounted for over 50% of new player growth in 2025, even as mature markets slowed.

Local Publishing Partnerships and Regulations

To unlock these markets, many publishers partnered with regional distributors or studios. Local partners help navigate:

- Payment systems (e.g., local wallets and bank transfers)

- Legal frameworks that differ significantly by country

- Cultural content guidelines required for compliance and player trust

These partnerships often speed approval, strengthen regional distribution, and reduce friction that global publishers face when entering markets with diverse regulations and player expectations.

Cultural Localization: What Worked (and Didn’t)

Localization in 2025 went beyond language.

Games that included cultural context, regional monetization, and responsive UX/UI performed better.

They showed higher retention and stronger monetization. In contrast, titles that relied only on direct translation often underperformed.

For example, players in Southeast Asia and the MENA region responded best to mobile-first games. Engagement increased when content was localized to match regional preferences, culture, and payment habits.

This pushes publishers to rethink one-size-fits-all global launches.

Game Publishing Insights 2025 on Marketing & Community Engagement

In 2025, publishers leaned heavily into community platforms and social media to build early awareness and long-term engagement. They moved away from purely paid campaigns.

Key engagement platforms in 2025:

- TikTok: Became vital for organically driven discovery and viral gameplay clips, especially for mobile and indie games.

- Discord: Centralized community dialogue, tester groups, and live engagement during soft launches.

- Reddit: Fueled genre-specific discussions and feedback loops that influenced roadmaps and patch priorities.

Influencer marketing also evolved. Mid-tier and niche creators often delivered better ROI than large influencers. Their audiences were more focused, and engagement was higher for each dollar spent.

Together, these platforms helped publishers test messaging and build trust early. As a result, community engagement became a core part of game publishing strategy heading into 2026.

Game Publishing Insights 2026: Forecasting Emerging Trends

Based on how the video game industry performed in 2025, several clear patterns are shaping publishing strategies for 2026.

Publishers are becoming more risk-aware, more data-driven, and more selective about where they invest.

One major shift is the rise of hybrid monetization models.

More games are moving away from pure premium pricing or heavy microtransactions. Instead, they combine upfront purchases with optional live-service features, cosmetic items, or DLC.

This model creates more stable revenue. It also maintains player trust and has shown long-term success across PC, console, and mobile platforms.

Another noticeable trend is the move toward smaller, high-quality releases.

After years of escalating budgets, many publishers are stepping back from blockbuster-only strategies.

In 2026, expect more focused projects with tighter scopes, faster development cycles, and clearer target audiences, especially from indie publishers and mid-sized studios.

Technology also plays a growing role. AI-powered QA, localization, and player support tools are becoming standard across publishing pipelines.

These tools help reduce costs, speed up releases, and maintain quality across multiple regions, making them especially valuable as vodeo game publishers scale globally.

What Publishers Should Prioritize in 2026

To stay competitive as the gaming industry business model evolves, publishers should focus on a few key priorities:

- Diversified Platform Strategy: Do not rely on a single storefront or ecosystem. Cross-platform launches and flexible distribution help reduce risk.

- Audience Segmentation & Niche Targeting: Data from 2025 shows that clearly defined audiences often perform better than broad launches. This is especially true in crowded genres.

- Long-term IP Investment Over Short-term Gains: Strong franchises and active communities create lasting value. They outperform one-time monetization spikes.

Together, these priorities point to a shift toward stability, scalability, and smarter risk management in game publishing.

Conclusion

The game publishing insights of 2025 send a clear message for 2026. Publishers who adapt quickly, use data well, and invest with purpose will have the strongest advantage.

Key lessons came from many areas. These include changing monetization models, smarter use of technology, and regional expansion. Together, they are shaping a more focused and efficient publishing landscape.

The video game industry will continue to evolve. Staying informed is no longer optional; it is a competitive advantage.

Publishers and developers who learn from past results and adjust in real time are the ones most likely to succeed.

Want to stay ahead?

Subscribe to the Gamespublisher.com newsletter! Get monthly game publishing insights, video game publisher news, trend analysis, and forward-looking forecasts built for developers, publishers, and industry professionals.

Loading survey...